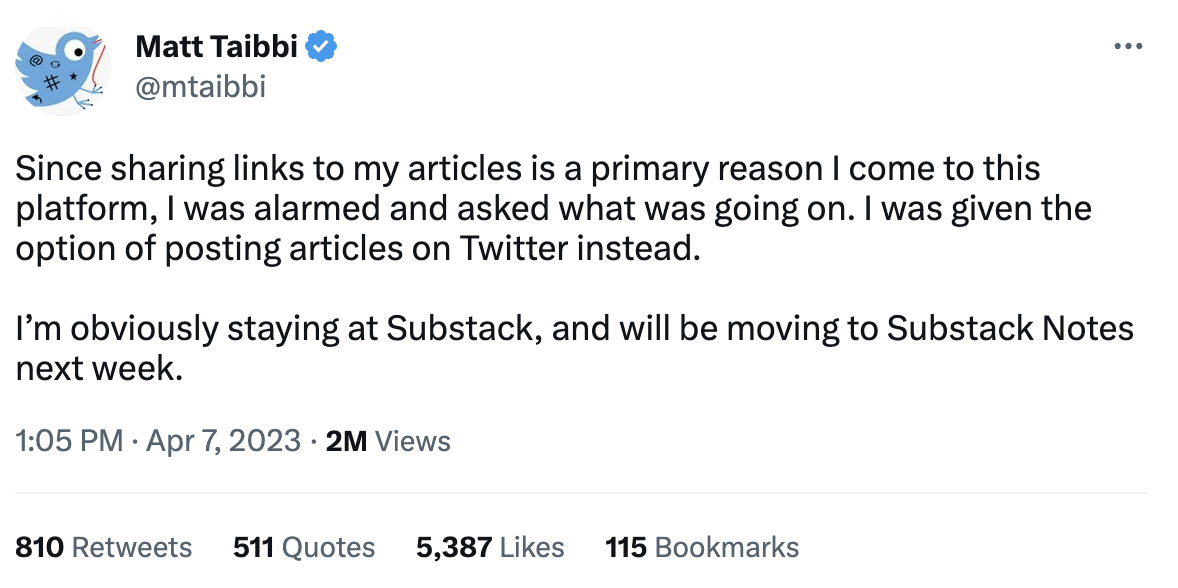

Something significant happened on Friday morning.

Twitter pushed out a code tweak that prevented users from engaging with anything having to do with Substack, a subscription newsletter service popular among independent writers, creators, and journalists.

While some of the suppression features have since been reversed, Twitter unilaterally (and without warning) made the decision to:

Block tweets that include a link to a Substack newsletter.

Block engagement such as likes, retweets, and comments on tweets that include a Substack link.

Redirect search traffic for “substack” to results for the term “newsletter”

Block user attempts to pin a tweet that includes a Substack link to their profile.

Remove the ability to embed tweets within Substack newsletters.

Block Twitter API access on Substack to break authentication.

When pressed for comment, Substack CEO Chris Best said of their users, “their livelihoods should not be tied to platforms where they don’t own their relationship with their audience, and where the rules can change on a whim."

While the conversation quickly turned to politically-charged topics such as censorship, free speech, and Orwellian decision-making (although good luck finding any references on Twitter), the reality is that the implications of actions such as this are much bigger than Twitter and Substack — and they can impact you and your brand.

It’s called platform risk. Let me explain.

Understanding Platform Risk

Platform risk is the exposure of any individual or business to communication suppression when distribution is managed by a third-party service provider. These channels are “rented” spaces, meaning a brand’s relationship with its audience is indirect and rented, rather than direct or “owned.”

This isn’t just limited to social media networks, it also includes content networks such as YouTube or Spotify, and search engines such as Google or Bing. If you’re relying on any third-party to access your audience, there is inherent platform risk to the distribution of your content and communications.

At any given time, the third-party platform can implement changes to their engagement and distribution algorithms that compromise access to your audience. It’s not just Twitter — platform risk is escalating across all platforms:

A growing number of governments across the world have banned TikTok from devices issued to staff as privacy and cybersecurity concerns rise — a handful of which (including the US) are considering or have otherwise imposed nationwide bans on the popular video-sharing app.

Facebook’s organic reach is declining at a rapid pace, as 50M businesses with professional profiles posting an average of 1.5 times a day to reach just 2% of their audience, a small and shrinking percentage. As a result, advertising-based media companies like Buzzfeed who have relied on organic traffic from Facebook have seen user engagement and ad revenue drop considerably.

LinkedIn has admitted to running algorithmic experiments on more than 20 million users, many of which, according to the New York Times, may have affected some people’s livelihoods. LinkedIn creators have commented on recent changes to the algorithm that have suppressed engagement with posts on platform.

The examples above highlight different types of platform risk:

Moderation Risk: Targeted suppression of content shared on platform. This weekend’s news of Substack and Twitter fall squarely into this category. Other examples of moderation risk include accounts being suspended or banned arbitrarily.

Algorithmic Risk: Global changes made to an algorithm that limits distribution of and engagement with content shared on platform. The changes that LinkedIn has implemented (without public comment) are an example.

Popularity Risk: Existential changes to any given platform that can negatively impact organic reach. Facebook falling out of favor with younger generations and a looming TikTok ban are examples of popularity risk for brands and creators who have spent years building their followership on these platforms.

Platform risk isn’t just for politicians, media outlets, or independent creators — it can have a tremendous impact on a company’s relationship to its audience, and ultimately, marketing’s ability to influence revenue.

The Impact of Platform Risk on B2B Companies

According to LinkedIn’s own data, salespeople who regularly share content to their social networks are 45% more likely to exceed quota, and their companies are 57% more likely to get increased sales leads.

It’s not just true of salespeople.

Marketers have long implemented the adage of being where their customers are, and the truth is that they spend much of their time on rented platforms like Linkedin, YouTube, and Twitter… In fact, you could argue that the lionshare of marketing time and budget is focused on engaging audiences in rented spaces — whether that’s search result pages, social feeds, or recommended content suggestions.

Platform risk is a very real threat to our effectiveness as marketers — leaving our practice vulnerable in a few areas:

Audience Engagement. Content is only as good as the distribution strategy behind it — moderation or algorithmic suppression means our audience is not being shown content for reasons outside of our control.

Audience Migration. Amassing a large followership is useless if popularity risk removes the ability to migrate an audience to a different platform. Third-party platforms will never share your follower’s email addresses, which at the end of the day is still the primary method of communication between brands and customers.

Pipeline & Revenue. Thinking about audience engagement as a leading indicator to pipeline creation (and other commercial metrics), less engagement means generating less pipeline and revenue for your business.

The good news is that platform risk can be mitigated — but it starts with an understanding that incentives between brands and third-party platforms are fundamentally misaligned. What we’re seeing play out with Twitter and Substack this week is one extreme example of this very point.

In order to build durable and sustainable customer acquisition motions that are effective within this new reality, marketers will have to become their own channels for distribution.

How SaaS Marketers Can Mitigate Platform Risk

Building an “owned” relationship with your audience is the most effective mitigation strategy to platform risk. It’s not just a defensive motion — companies who build an engaged audience of subscribers to their content and thought leadership see more efficient growth and a healthier cohort of revenue once acquired.

What do we mean by owned audience?

An owned audience has opted-into a direct relationship with your brand by subscribing with their email address. In a previous post, I went into detail on the value of a subscription which is already widely appreciated in the consumer context (where companies like Substack, Patreon, and others have championed) and is now starting to make its way into B2B.

With email, brands can communicate directly with their audience without relying on a risky, third-party intermediary for distribution.

There are three key steps to building an owned audience:

Produce authentic content to establish trust. You don’t need to break the bank in order to start producing quality content that breaks through the noise pollution online. Focus on editorial formats like video, podcasts, live streams, and other mediums that are designed for humans, not algorithms.

Leverage rented channels to capture attention. With platform risk front of mind, marketers should rethink their relationship with rented channels with the intention to deplatform their audience into an owned audience of subscribers. But that doesn’t mean abstaining from them altogether. Use short form assets such as video clips, quote cards, and audiograms in order to tease engagement within the feed, but drive engagement back to your owned property for the full asset.

Create programs exclusive to subscribers. Create a strong value proposition behind subscription to your brand — whether that’s exclusive content such as newsletters, content for subscribers only, invites to exclusive experiences, or even merch. Gating access to membership in your brand — much like what Substack has enabled for their creators — rather than gating individual content assets.

Building an owned audience of subscribers gives you access to critical engagement data about your audience and what they care about — the same data that rented platforms have and hoard today!

The public battle between Twitter and Substack might be alarming to some, but it represents an incredible opportunity for marketers to build sustainable acquisition programs. Companies who are investing in owning their relationship with their audience are future-proofing their marketing efforts — and will look back on this weekend as the canary in the coal mine.

Anthony Kennada | About the Author

Founder and CEO, AudiencePlus

Prior to founding AudiencePlus, Anthony served as the CMO of incredible companies like Hopin and Front. He was the founding CMO of Gainsight where he and his team are credited with creating the Customer Success category -- a novel business imperative, profession and software category that helps subscription companies grow sustainably by becoming customer obsessed. By focusing on human first community building, content marketing, live events and creative activations, they developed a new playbook for B2B marketing that built the Gainsight brand and fueled the company’s growth from $0 to $100M+ ARR, and eventual acquisition by Vista Equity at a $1.1B valuation. You can follow him here.